A Primer on Mexico's Annual Hedge Deal

- bkkelly6

- Oct 11, 2020

- 7 min read

Author: Brynne Kelly (w/Lee Taylor technical levels)

There has been some chatter this week that the annual Mexican hedge transaction had started. We know that many years ago the Mexican government implemented an annual crude oil hedging program as part of their budget process. Their intent is to protect the oil revenue defined in their yearly budget through the purchase of put options. Recently, knowledge of this deal has received more press and it is now widely anticipated as a transaction large enough to move markets

As background, roughly 95% of the crude oil that Mexico sells to the US is Maya heavy crude for use by Gulf Coast refiners. Pemex (Mexico’s state-owned petroleum company) calculates their sales price (of Maya) as a derivative of other market prices. This 'formula' for calculating Mayan crude oil prices has been fairly constant over the last decade. However, with the advent of IMO 2020, the Maya pricing formula was changed in 2019 (ahead of the 2020 hedge program). It was expected that high-sulfur fuel oil prices would be more volatile after the new IMO regulations came into effect in January 2020. The new formula removed the high sulfur and sour crude component and made the Mayan product itself more 'hedge friendly'. This leaves it up to Pemex to adjust their Maya prices for sulfur quality using the K-factor. (new formula vs prior formula below).

This constant (K-factor) is updated monthly and posted on the Pemex website (found here). The constant is used to adjust the pricing formula monthly in relation to other market spreads in order to stay competitive. October's K-factor is shown below.

The K-factor becomes the trickiest part of the Mexico deal to hedge. It's fairly straight-forward to neutralize the flat price risk in the deal via WTI and Brent futures. Neutralizing the K-factor is more of an art because it is used to adjust Maya crude oil prices relative to similar grades landed in the US on a competitive basis.

So, what is the flat price risk those that participate in the deal are exposed to? Here is a summary:

Mexico buys Dec-20 through Nov-21 puts on Mayan crude oil from various market participants (typically large banks and/or oil majors).

This leaves the market participants short puts and long delta.

Given the Maya formula noted above this long delta exposure is weighted 65% to Argus WTI Houston and 35% to Ice Brent.

With the higher exposure to WTI Houston, it might be expected that the WTI/Brent spread would weaken as more WTI is sold than Brent to hedge exposure.

WTI/Brent Spread

As this deal is highly anticipated, many players in the market take positions in advance of actual hedge activity. One such position would be to go short WTI and long Brent (based on the fact that WTI is more heavily weighted in the Maya oil price formula).

Looking at the WTI/Brent spread futures curve over the last 10 days we see that the spread has remained fairly strong in the first 6 months. It's not until the 2nd half of 2021 that we see some weakness creep in.

In fact, this spread weakened from the 2nd half of 2021 through the end of 2022 by the end of last week (yellow line above). Again, this could be exacerbated by the production shut-in's from Hurricane Delta. However, if the Mexico deal hedging did in fact take place last week and the spread was unable to weaken, there could be spec players out there left holding the bag on WTI/Brent shorts in the front of the market. This will be something to watch.

WTI-Houston/WTI Spread

We have looked at the WTI and WTI/Brent curves, but the actual 65% pricing component in the Maya formula relates to Argus WTI Houston. For liquidity purposes, a participant may initially hedge their WTI Houston exposure with WTI Cushing futures. For a true hedge though, this WTI Cushing hedge will need to move to WTI Houston. So, let's take a look at the performance of the WTI Houston/WTI Cushing spread last week (below).

One would expect that this transfer of hedges from WTI Cushing to WTI Houston would result in some selling pressure on the Houston/Cushing spread. And, we do see that (yellow line above, in the deal term window of Dec-20 through Nov-21). However, the more dramatic move in the spread was in calendar 2022. In fact, there were quite a few 'cal 2022' spread trades that went through last week that drove the spread lower (lower meaning that WTI Houston lost value relative to WTI Cushing). We continue to see a pattern where calendar 2022 is weaker than calendar 2021. This begs the question: are market participants using hurricane-induced tightness to execute long-term hedges across the board beyond just the Mexico deal?

Dec/Dec Spread

Since the terms of the Mexican hedge deal run from December through November of the following year, the Dec/Dec calendar spread usually comes under fire when this deal is being executed. The front December contract is part of the deal term while the back December contract is not. In the prior 2 years, we see this in the chart below (blue and red lines, spread weakens in October).

In 2018 and 2019 we saw the spread weaken materially in October as market participants are eager to neutralize portfolio length acquired from selling put options to Mexico. Some of this move, historically, has been due to positioning ahead of the deal (sell Dec/Dec in anticipation of the deal similar to positioning ahead of the monthly fund rolls). Last week, however, there was buying in the front of the market due to hurricane Delta production shut-in's. As a result, the Dec-20/Dec-21 spread actually rallied (gold line, above). Was this a lucky break for those that participated in the Mexican oil trade or does it mean that the deal has not yet kicked off? We think it was a lucky break. Meaning that traders may have gotten short this spread in anticipation of the deal. Then, a late-season hurricane shows up to tighten supply in the front, temporarily.

WTI Futures

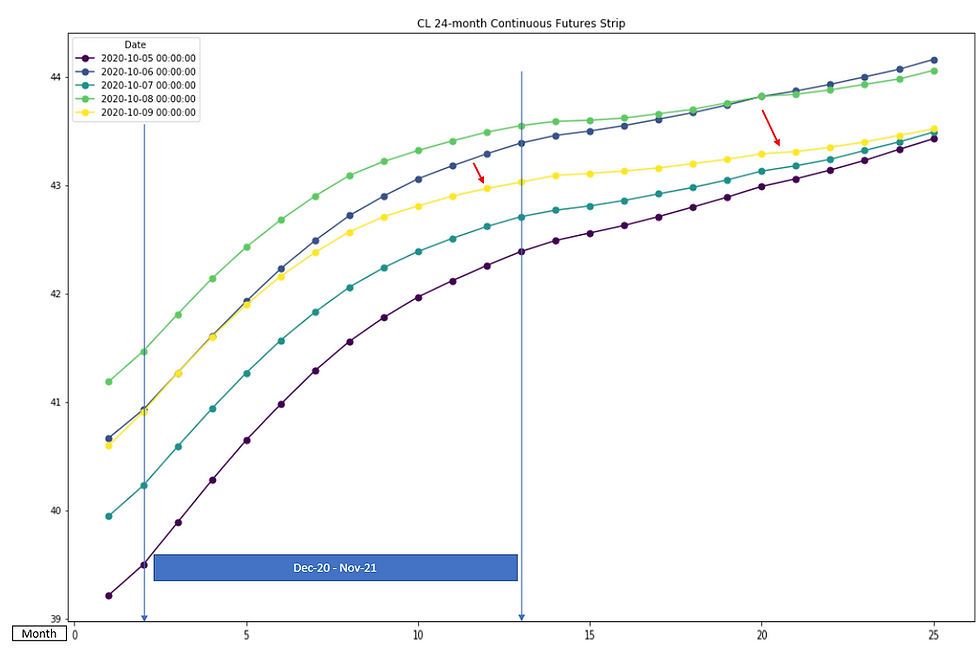

Looking at the 2 year continuous futures strip in WTI, we see an interesting dynamic developing last week (gold line = Friday 10/9, purple line = Monday 10/5). For the last several months, we have seen the futures curves 'shift' almost in parallel. This changed last week where we finally saw the front de-couple from the back.

In fact, by month 25 on a continuous chart the week ended almost exactly where it began. It's already the 4th quarter of the year and we are finally seeing some hedge activity in the back of the curve (even beyond the term of the Mexico deal).

Do we think the Mexican hedge kicked off last week? The evidence presented above seemed inconclusive. If the market impact of the 'Mexico hedge' was offset by the storm (Delta), then once production is in the clear we would expect both front and calendar 2021 spreads to weaken.

Of note last week

Hurricane Delta had a significant impact on US crude oil production. As of the latest BSEE report, there is still over 90% of Gulf of Mexico production shut-in. The days shaded in blue are those that will be included in the EIA inventory report for week ending 10/9/20. Something to keep in mind this week.

EIA Inventory Statistics

Weekly Changes

The EIA reported a total petroleum inventory DRAW of 3.20_million barrels for the week ending October 2, 2020 (compared to a draw of 6.50 million barrels last week). Commercial Crude oil inventories were essentially flat on the week.

YTD Changes

Year-to-date, total inventory additions stand at a BUILD of 76.70 million barrels (vs 79.60 last week).

Inventory Levels

Commercial Inventory levels of Crude Oil (ex-SPR) and Distillate are still above their 5-year average in, however, gasoline inventories have fallen to within their 5-year average.

Lee Taylor - Technical Levels

BRENT

Resistance: 43.84 / 45.49 / 46.97

Support: 41.90 / 40.77 /38.77

The result of President Trump getting the Covid-19 virus, another hurricane in the Gulf of Mexico, plus a discount of possible more shutdowns in some major cities caused the market to retest $40 in Nov WTI rather than test the triple bottom below between 36.58-36.63. Nov WTI needs to hold 40.30 here to make another push to the upside and then break above and settle above 41.18. A settlement above 41.18 projects up to 44.02. -.30 cents remains strong support for the spot WTI spread with downside to -.36 and upside of -.24.

WTI

Resistance: 41.72 / 42.75 / 44.05

Support: 39.10 / 37.02 / 36.58

The result of President Trump getting the Covid-19 virus, another hurricane in the Gulf of Mexico, plus a discount of possible more shutdowns in some major cities caused the market to retest $40 in Nov WTI rather than test the triple bottom below between 36.58-36.63. Nov WTI needs to hold 40.30 here to make another push to the upside and then break above and settle above 41.18. A settlement above 41.18 projects up to 44.02. -.30 cents remains strong support for the spot WTI spread with downside to -.36 and upside of -.24.

RBOB

Resistance: 1.2584 / 1.2782 / 1.3253

Support: 1.1735 / 1.1317 / 1.0854

The gasoline market has been trading in a 20-cent range since early June between 1.0854 to 1.2782. The 1.2782 is the 50% retracement level on the weekly chart that begins spring of 2019 and bottoms out at the antapex during the onslaught of the Covid-19 pandemic. Please keep in mind that roughly the same level exists in the monthly charts – 1.2796 as 50% retracement.

HEATING OIL

Resistance: 1.2103 / 1.2323 / 1.2888

Support: 1.1746 / 1.1476 / 1.1235

What a difference a week makes! The heating oil market was in jeopardy of heading below $1.00 again but rallied from the enormous macro sell off 7 business days ago. November heating oil now needs to hold 1.1746 and settle above 1.2016 to have another test of 1.300. A lackluster settle under 1.1746 and we should see 1.1476. Heating oil spreads are off to the races especially Dec/March heat – if it stays above -372 or even -410 for that matter, a retest of its highs of -248 is likely.

Comments