Repeatable Patterns

- bkkelly6

- Jan 18, 2022

- 8 min read

Flashback to 2008: Pre-Financial Crisis and Pre-Beijing Summer Olympics

Author: Brynne Kelly 1/18/2022

Thirteen years ago, Beijing impressed the world with the outstanding delivery of the Summer Games which left numerous memorable moments not only for the audience but also the athletes, and the whole Olympic family.

Beijing 2008 left priceless legacies for the eastern giant, playing a big role in the development of sports afterwards and leaving legacies that are still being built on today in the preparation for the 2022 Winter Games. In addition, it coincided with one of the largest rallies in oil's history.

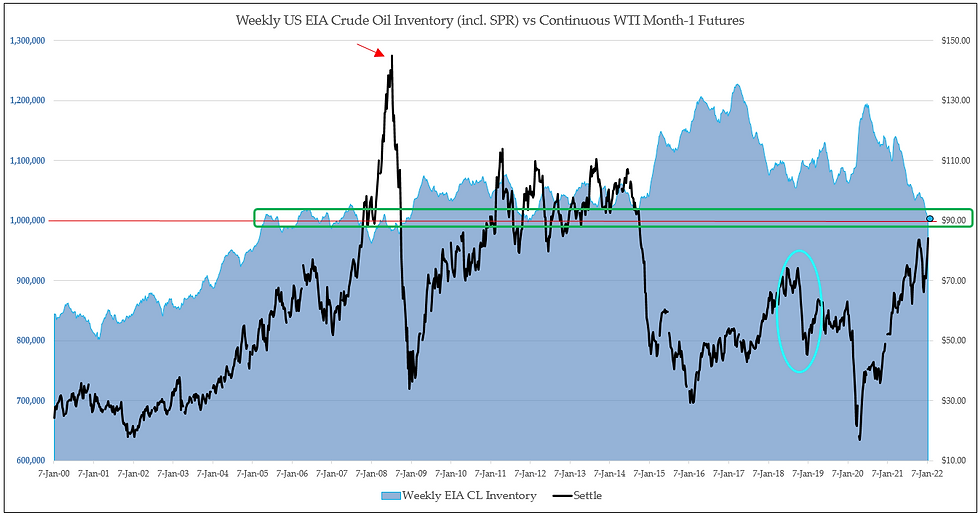

In 2008, it was reported that "the 2008 Beijing Olympic Games will boost China's rampant demand for energy, threatening to push world oil prices beyond current record heights, according to industry analysts". Crude prices surged as a result to strike a record high above 130 dollars per barrel, boosted by tightening supplies, underinvestment in global production and ongoing unrest in key producer Nigeria.

Sound familiar?

Fast forward to 2022. In February Beijing will host the 2022 Winter Olympics, which will focus an international spotlight on the country’s performance. Additionally, in the fall, Xi Jinping, China’s leader, is expected to claim a third five-year term at a Communist Party congress.

Why do we mention the Beijing Olympics? Because it was considered one of the catalysts that pushed oil prices above the $100 level for the first time in 2008. Ironically, US inventory levels are now at similar levels today that they were back in 2008. Similar narratives lie beneath both - fears that global investment in oil resources are lagging demand. Will another Olympic games in Beijing mark the beginning of a similar move in 2022, the end of the current move, or is it a mere coincidence that the same pattern seems to be setting up again?

First, let's review some of the key narratives last week that contributed to upside momentum ahead of the 2022 Winter Games.

The Events That Shaped Last Week

CHINA SPR RELEASE

Last week, China announced that it will release crude oil from its national strategic stockpiles around the Lunar New Year holidays that start on Feb. 1 as part of a plan coordinated by the United States with other major consumers to reduce global prices, sources told Reuters

BANK COMMENTARY

On January 13, JPM publicly forecast oil prices to rise as high as $125 a barrel this year and $150 a barrel in 2023. "We see growing market recognition of global underinvestment in supply," the bank said.

LIBYA UPDATE

Last week, the Libyan NOC announced that it was Halting Exports from Es Sider Oil Port due to bad weather. They also stated that 50k bpd of Waha Oil Production was also cut. Prior to this news, the NOC media office reported that Libya's total oil output is 896,000 barrels per day. Update: Libya Says Oil Output Back to 1.2 Million Barrels a Day

PIPELINE EXPLOSION IN VENEZUELA

On Monday January 10, it was reported that a condensate pipeline in Naricual, Venezuela had blown up after someone allegedly attempted to siphon it. It was described as a large explosion with an unknown number of casualties.

DRONE ATTACK ON THE UAE

DUBAI (Reuters) -Yemen's Iran-aligned Houthi group attacked the United Arab Emirates using drones on Monday January 17, setting off explosions in three fuel trucks (not tankers) and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. The strike on a leading Gulf Arab ally of the United States takes the war between the Houthi group and a Saudi-led coalition to a new level, and may hinder efforts to contain regional tensions as Washington and Tehran work to rescue a nuclear deal. Dr. Anwar Gargash, Special Adviser to the UAE President, described the group as a "terrorist militia" after two blasts in the capital. Explosions that killed three people in Abu Dhabi on Monday were a "heinous attack on civilian facilities" by Yemen's Houthi militia, a senior Emirati official said.

TONGA VOLCANO

On Saturday, January 15 an underwater volcano in the South Pacific erupted Saturday with a stunning blast, sending tsunami waves onto nearby Tonga and to the north in Japan, with warnings of dangerous ocean surges issued as far away as the US West Coast. Dramatic satellite images showed the long, rumbling eruption of the Hunga Tonga-Hunga Ha'apai send a huge mushroom of smoke and ash into the air and a shockwave across the surrounding waters. A tsunami wave measuring 1.2 metres (four feet) was observed in Tonga's capital Nuku'alofa, according to Australia's Bureau of Meteorology.

NORTH KOREA SRBM (short-range ballistic missile)

SEOUL (Reuters) - North Korea fired two suspected short-range ballistic missiles (SRBM) on Monday, January 17 from an airport in its capital city of Pyongyang, South Korea's military reported, the fourth test this month to demonstrate its expanding missile arsenal.

Japan also reported the launch, with chief cabinet secretary Hirokazu Matsuno condemning it as a threat to peace and security while China urged all sides to preserve for stability. "We call on relevant sides to keep in mind the overall peace and stability on the peninsula," Chinese foreign ministry spokesman Zhao Lijian told a daily briefing in Beijing when asked about the suspected launch.

WINTER STORM IZZY

A major winter storm erupted over the weekend, dropping snow and freezing rain on the Southern U.S. and sending temperatures plunging, cause hazardous road conditions and power outages before eventually moving up the East Coast. The major system was projected to leave more than a foot of snow and in excess of a quarter inch of ice in some areas, the National Weather Service warned. Airlines canceled over 2,700 U.S. flights on Sunday as a winter storm combining high winds and ice was poised to hit the U.S. East Coast over the holiday weekend.

MARKET IMPACT

A continuous stream of news has been playing with the heart strings of oil market sentiment. On the one hand, Omicron looms in the background continually threatening to dampen demand, even managing to pull the market lower at the end of 2021. On the other hand, weather, geopolitical risk, and underinvestment narratives continue to swoop in and provide the tailwind needed to push markets higher.

In both directions, crude oil has a history of overshooting it's mark and then violently reversing course. We see this in the pattern of WTI calendar strips (below). In 2018 the prompt calendar strip (2019) went from a high of around $75 to a low of around $49 at settlement. That is a 35% drop in a matter of months. In fact, that decline was preceded by an almost 50% increase in the calendar 2019 strip. We saw a similar increase in the prompt calendar spread (2023) from the end of 2021 to now. The calendar 2023 strip went from a low of around $46 to a high of around $72 as of last Friday's settlement. A 36% increase.

This movement in 12 month calendar strips is echoed by 12 month calendar spreads over the last several years. Note how the calendar spreads tend to follow movements in the strips - as outright prices make new highs, so do calendar spreads (chart below).

One anomaly reveals itself when comparing the performance of 12-month calendar spreads in 2008 and 2009 (black and red lines below) to those in 2014 and today. Remember from our opening chart that it was during 2008 that oil prices moved above $130/bbl before collapsing to around $30 by the end of the year. During that rally, backwardation in 12-month calendar spreads like Dec/Dec peaked at around $5.00. This is almost half that of where backwardation peaked in 2014 (cyan line below) and 2021 (lime green line below).

It seems as though crude oil prices in the front move first, which pushes calendar spreads towards extremes. Term structure is dealt with later. Once the market becomes invested in the space and the narrative, it then works to assess curve structure. At some point the disparity between the front and the back needs to make sense and be reconciled. For example, will inventory builds precede a selloff in time spreads, or will a selloff in time spreads precede a period of inventory builds? So far, in the last 12 months we have see nothing but draws from both commercial and reserve inventories.

In 2008, it was the global financial crisis that led to the huge decline in oil prices, NOT excess inventory builds. In 2014 it was the start of the shale revolution ahead of the US lifting it's export ban that filled inventories and led to another large selloff in outright prices and spreads (again, refer to the first chart in this post). And, recently it was the global pandemic in 2020 that once again sent oil prices lower and calendar spreads into contango. This seems to happen about every 6 years - that we have a major correction as time spreads reach their limits and can no longer be justified.

Of course we must also consider how crack spreads are performing. Setting aside the chaos brought on by the pandemic in 2020, and its notable that continuous front month WTI cracks have maintained a fairly stable, and repeatable seasonal pattern.

All eyes will be on summer gasoline cracks as supporting evidence of healthy end-user demand. Also, given the LNG shortages in Asian and European countries this winter, it would be expected that heat cracks will remain strong. Weakness in either of these could drag down oil prices.

Last week, we got our first US EIA inventory data point for 2022. It confirmed that we are starting 2022 with combined crude oil, gasoline and distillate stockpiles at levels not seen since 2014 (yellow dot below vs red line). The excess inventory created by both the ramp-up of US shale oil production (prior to the export ban) and the global pandemic have been erased (in the US).

At the very least, this will keep a storage bid under the market. The question is whether or not the US needs to hold more inventory than this to keep the overall system operating smoothly. Also included in the above chart is combined inventory levels during 2008 (the year that oil prices broke above $100 for the first time, fuchsia line above).

According to the EIA, in 2021, withdrawals from global petroleum inventories averaged 1.4 million barrels per day (b/d) and contributed to higher crude oil prices. These inventory draws resulted from petroleum consumption returning faster than petroleum production after the COVID-19 pandemic began in 2020. In 2022, they expect that petroleum production will increase and consumption growth will slow, leading to increases in petroleum inventories globally. They forecast that global petroleum inventories will increase by 0.5 million b/d in 2022, which will put downward pressure on crude oil prices. That would be a total increase of 180 million barrels for the year.

This is a tall forecast and makes each successive weekly inventory release that much more important. The market is looking for said inventory growth to materialize. Will the conclusion of the 2022 Beijing Winter Olympics kick this off?

Bottom Line

Overall, global oil markets in the second quarter of 2022 are likely to be in a fragile balance and are forecast to move to a structural surplus. In fact, Goldman Sachs this morning stated that it 'Expects Inventory Draws To Narrow But Persist Through Q122, With The Global Oil Surplus In Q222 Smaller Than Seasonal At 0.4 MB/D'. Quite interesting considering over 50 million barrels will be added to the market during Q1 2022 from US-led global SPR releases.

It's also interesting to note the bookends created by the 2008 and 2022 Olympics hosted in Beijing. China spends a lot of money readying it's country for a global show.

While the Winter Games do not have quite the prestige of the Summer competition, a successful Olympics next year could be as valuable a soft power win for China as 2008. A successful Beijing 2022, with hundreds of thousands of vaccinated, mask-free spectators packing stadiums, could serve as the ultimate proof of concept for China's authoritarian political system, and Xi's continued tight control over it.

Of Note Over the Weekend

Goldman Sachs: Iran's production isn't expected to ramp up until 2023, with the risks of an earlier return becoming outweighed by the risks of disruptions rising from their decade-low levels in 2021.

Goldman Sachs Sees Brent Oil Hitting $100/BBL In Q3 2022 - RTRS

__________________________________________________________________________________

EIA Inventory Recap

Weekly Changes

The EIA reported a total petroleum inventory BUILD of 5.70 for the week ending January 7, 2022 (vs a net BUILD of 11.0 last week). However, inventories at Cushing continue to draw.

YTD Changes

Same as Weekly for the first week of the year

Inventory Levels

Commercial Inventory levels of Crude Oil (ex-SPR) compared to prior years are have gone from way above historical levels to surprisingly below historical levels and should continue to draw as long as backwardation in the market persists.

Comments