Oil Spreads at Record Highs: However, Time is Running Out

- bkkelly6

- Jul 10, 2022

- 6 min read

Author: Brynne Kelly 7/10/2022

A few weeks ago, we detailed how the US crude oil supply deficit is being met via releases from the US Strategic Petroleum Reserves in a post titled: Tension Has Been Given a Timeline:

The focal point of that timeline is Fall 2022. By this Fall OPEC is expected to have restored production fully while US production will have hopefully fully recovered just as the SPR releases end. These events are expected to converge before next winter.

There has been no material change in commercial US inventory levels or production since then. The fundamental backstory is largely the same but oil prices have taken a hit as central banks raise interest rates to tame inflation, spurring fears that rising borrowing costs could stifle growth. However, the calendar spreads that are being used as a focal point of the supply problem have held their ground. Specifically, Sep/Dec and Oct/Jan in both WTI and Brent.

Sep/Dec (left), and Oct/Jan (right) continue to signal supply concerns...

For reference, look at the historical nature of the Sep/Dec calendar spread in WTI...

Notice the outlier that is the prompt Sep/Dec spread in WTI (lime green line above) in relation to that same spread in 2023 (gold line above). Once again highlighting that the worst of the 'problem' is for now contained and not being expressed to the same extent in the future. All of the markets proverbial eggs appear to be in one or two baskets.

The two months that are typically considered lower demand 'shoulder months' currently have the highest relative value to everything else. The problem with this is that time is running out on them. The expiration window for the September contracts isn't far off (Sep Brent expires in 19 days and Sep WTI in 39 days). Meaning, traders either have, or will start to roll out of them.

We have not witnessed spreads such as these at levels this high. Neither have we seen them persist at such high levels this close to expiration. Said another way, time is running out for the market to make a decision one way or another, barring some sort of new material event.

Given these spreads' ability to stick despite recent downside volatility in flat price it is worth quickly revisiting the drivers behind them.

What is behind this? Inventory.

Since these spreads are key in seasonality transitions, it warrants a look not just at the crude inventories, but the products as well. Lets start with Crude.

Crude Oil Inventories

We know that in the US, strategic reserves are being used as a stop gap for supply. In fact, these reserves are being drawn down at a significantly material rate. Yet, this has not translated to an increase in commercial inventory levels so far.

The recent rapid decline in SPR levels (black line labeled 2 below) is not showing up as a gain in commercial inventory levels (green line below). However, in the previous drawdown of SPR (Labeled 1) the commercial inventories built up some to compensate.

Weekly SPR vs Commercial Inventories...

Additionally, from here, another 90 million barrels are set to be released from the SPR between now until the end of September. The chart below bears this out. Absent builds in US commercial inventories to offset this, combined US inventories (commercial plus SPR) will approach significant historical lows (yellow dot below).

SPR and Commercial Crude Inventories Combined...

This picture underpins the reason market participants are so interested in owning 'Fall' barrels of oil, but it doesn't explain the lack of interest beyond that as expressed through such large backwardation. Again, time is running out to validate if there is more to come, or if the worst is over in these spreads. It seems products spreads also validate the current tension coming to a head soon.

Refined Products Inventories

High prices have given birth to demand destruction narratives. But, there isn't much to support that narrative so far under the hood. A simple comparison of refined product demand (using product supplied data from the EIA, commonly used as a proxy for demand) and the corresponding EIA inventory data shows that demand is on the rise while inventory levels remain stagnant.

Below, we provide side-by-side comparisons by year of product demand (left charts below) to their corresponding inventory levels by year (right charts below) for both distillate and gasoline.

Distillate

Gasoline

The red line in all the above charts represents 2022 data. There is nothing in this data that suggests balances are loosening yet.

Many Wild Cards Remain

The above narrative is nothing new. What is new is the persistence of these spreads as we near expiration. We have been keeping an eye on it for months now in search of a meaningful change in the trend. None have materialized. So, what are the wild cards out there that could materially impact the current trend either way?

OPERATIONAL ISSUES

The oil producing and refining complex remains under pressure to perform. Specifically, the physical assets are under pressure. There is little room for error when every molecule produced is needed. Yet, these vital operational assets continue to experience issues.

US refiners are running at a 21-month high, testing equipment limits to sustain high rates of production without breakdowns. “Running hard increases general stress on a unit, increasing the risk of an unplanned outage,” said Robert Campbell, head of oil products research at London consultancy Energy Aspects Ltd. “When the weather is hot, cooling tower efficiency is reduced and everything needs the cooling,” Campbell said. High run rates risk abrupt breakdowns that could force a refiner to seek replacement products that cost more to buy than make.

To make matters worse, over the weekend it was reported that there was an explosion at a natural gas gathering and processing facility near Medford, Oklahoma, which could disrupt the flow of hydrocarbons to energy export hubs on the Texas Gulf Coast.

For perspective, here are some of the more significant asset issues we have seen over the last year:

July 9, 2022- ONEOK natural gas plant explosion (Medford, OK)

July 7, 2022- Energy Transfer pipeline explosion (Wallis, TX)

Jun. 27, 2022- Petro Star refinery explosion, (VALDEZ, AK)

Jun. 8, 2022- LNG natural gas plant explosion (Freeport, TX)

Apr. 24, 2022- Valero refinery explosion (Meraux, LA)

Apr. 14, 2022- Haven Midstream gas plant explosion (Haven, KS)

Mar. 27, 2022- ExxonMobil oil refinery explosion (Billings, MO)

Feb. 21, 2022- Marathon Petroleum refinery explosion (GARYVILLE, LA)

Dec. 23, 2021- ExxonMobil plant explosion (Baytown, TX)

June 23, 2021- Calpine Natural Gas Generation Plant explosion (Corpus Christi, TX)

July 22, 2021- Northern Natural Gas explosion (Ellsworth County, KS)

Running assets hard, particularly in summer heat, wears units down faster, reducing the time between turnarounds and increasing the cost of repairs when they do finally get taken down for maintenance.

Refinery utilization rates have recovered significantly since 2020. Now we look ahead towards the dreaded seasonality of refinery maintenance and hurricane season.

There is risk on the horizon for either a smooth, seasonal decline in demand as a result of refinery maintenance or a quick loss of refining demand due to hurricane damage. Either scenario results in less crude oil demand. This is a wild card that will factor in as spreads like Sep/Dec approach expiration.

GEOPOLITICS

On his first trip to the region since taking office, President Biden will begin in Israel, which has been building relations with Arab nations. He will also make a stop in Saudi Arabia. His last official trip to the region was six years ago. Alliances and priorities have shifted significantly since then.

Biden needs oil-rich Saudi Arabia’s help at a time of high gasoline prices and as he encourages efforts to end the war in Yemen after the Saudis recently extended a ceasefire there. The United States also wants to curb Iran’s influence in the Middle East and China’s global sway.

Many expect him to walk away with some sort of commitment from the Kingdom to help ease supply issues. Bad news on that front could provide another leg higher in oil prices, especially as Iran nuclear talks continue to stall. A successful trip however could ease supply fears.

Bottom Line

The last two weeks have seen some volatile moves in both directions for oil flat-price. Additionally the noise of news that may or may not have a real impact has gotten louder as the main stream media picks up on multiple energy topics from inflation, to Gas supplies, to unstable power grids. One news item about exported SPR oil made for a good headline but is not as significant as the total shortfall we are running up against soon.

But revisiting the Timeline established a few weeks ago and reassessing the fundamentals remains relevant. The supply side is still at risk, the SPR drawdown has a known end, Biden is looking to get more oil out of the Middle East, and winter (and hurricane season) is coming for refiners. All of this has to be cleared up (even if only temporarily) by September/ October.

If all the above is true, and the U/Z and V/F spreads are the current poster children for this timeline, then something should happen soon as expiration approaches. Whether that be a blow-off rally, a quick drop, or an orderly rollover remains to be seen

__________________________________________________________________________________

EIA Inventory Recap - Week Ending 7/01/2022

Weekly Changes

The EIA reported a total petroleum inventory DRAW of 1.40 for the week ending July 1, 2022. However, commercial inventories rose again by 8.30.

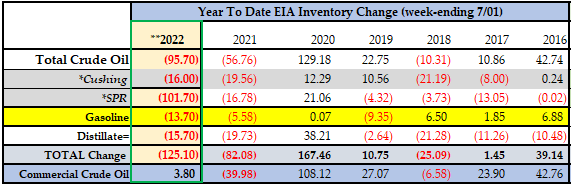

YTD Changes

YTD total petroleum EIA inventory changes show a DRAW of 125.10 through the week ending July 1, 2022.

Inventory Levels

Commercial Inventory levels of Crude Oil (ex-SPR) compared to prior years are have gone from way above historical levels to surprisingly below historical levels and should continue to flounder while backwardation in the market persists.

Comments