Will a Pipeline Outage Move Markets?

- bkkelly6

- May 9, 2021

- 6 min read

Author: Brynne Kelly 5/09/2021

Colonial Pipeline, the largest U.S. refined products pipeline operator, has halted all operations after it fell victim to a cybersecurity attack on Friday. The latest media statement from the pipeline itself did not offer any information regarding the restart of the 2.5 million bpd gasoline and products pipelines:

Colonial transports nearly half of the East Coast’s fuel supply through a system that spans over 5,500 miles between Texas and New Jersey. It also serves some of the country's largest airports, including Atlanta's Hartsfield Jackson Airport, the world's busiest by passenger traffic. Colonial said it had engaged a cybersecurity firm to help the investigation and contacted law enforcement and federal agencies. The U.S. Department of Energy is coordinating with Colonial Pipeline, the energy sector, states and interagency partners to support response efforts, according to an agency spokesperson.

The incident is one of the most disruptive potential digital ransom operations ever reported and has drawn attention to how vulnerable U.S. energy infrastructure is to hackers. A prolonged shutdown of the line would cause prices to spike at gasoline pumps ahead of peak summer driving season, a potential blow to U.S. consumers and the economy.

The ultimate impact of the attack on fuel prices is unclear since there’s been no timeline given by Colonial Pipeline as to when they would resume operations. Additionally, the market didn't have much information last Friday to properly assess its implications and position accordingly. We didn't get a lot more clarity over the weekend either. As we head into a new trading week , we thought it was a good time to dig into some of the spreads we would expect to react as more information becomes known. Should this turn out to be more than a temporary event, what spreads might be impacted? For that, we look at the following spreads to watch as their movements will signal which way the market is leaning.

Indicative Spreads:

- Location Spreads

- Time Spreads (front vs back)

- Crack Spreads

Location Spreads

A shutdown of the pipeline lasting four or five days could lead to sporadic outages at fuel terminals along the U.S. East Coast that depend on the pipeline for deliveries. In fact, on Sunday night the FMSCA announced that limits on trucker hours would be waived temporarily to allow fuel shipments by truck. Trucking fuel to the US east coast is costlier than shipping via pipeline and therefore we would expect location spreads to signal how material this pipeline outage is.

According to myriad market sources, both main lines of the 2.5 million b/d refined product pipeline system were impacted, stranding barrels of gasoline, diesel and jet on the USGC. If this were actually problematic, USGC products should become more discounted to their counterparts in the New York Harbor do to increased costs (trucking vs pipeline; imports vs local production). This did, in fact happen last week, although as you can see from the chart below, this spread had already been selling off towards the lows seen during the TX polar vortex. Further weakness in the spread would be needed to validate the theory that the Colonial pipeline disruption is material and the spread is widening out in order to price in increased shipping costs.

Another source of supply for the US east coast would be from Europe (European EBOB). Imported barrels of transport fuels into the US creates a RIN obligation. Therefore, in order to attract barrels, NYH prices need to move to a level that covers not only the cost of shipping, but also the cost of the RIN obligation. As RIN prices have rallied this year (A Primer on RIN's and Futures Prices) so has the RB/EB spread. The current cost of the renewable volume obligation is around $0.19/gallon and the RB/EB spread is $0.23/gallon. Basically, there was no change in the current spread trend last week that could be notably attributed to Colonial Pipeline news.

Another popular spread that reacts to logistical transport issues is the 'arb' between WTI and Brent. This spread not only indicates global demand but also how strong that demand is based on the extent to which it covers tanker rates. A spread that is lower than actual shipping costs is a sign of weakness. We saw little reaction in WTI/Brent spread futures last week, especially in the front of the curve (below, 10-day futures curve shift) where one might expect some tightening of the spread if refined product imports to the US east coast are needed to fill the void left by pipeline deliveries from Colonial Pipeline.

One might have expected the spread to widen as Brent-linked barrels are needed to fill the refined product void on the US east coast. Again, we saw nothing significant through last Friday's close.

Crack and Product Spreads

Refined product cracks are another indicator of supply/demand issues. Toward that end, we compare the movements in Brent cracks over time. Specifically NYH Brent cracks and European gasoline cracks (chart below). All three spreads have been rallying along with the rest of the complex this year, however the ULSD vs Brent spread ended the week on the strongest note of the 3 last Friday. Should there be no concrete follow-through next week, the pipeline disruption will end up being a non-event as far as crack spreads are concerned.

The relationship of gasoline to ULSD is a volatile one with many seasonal patterns. On a 12-month continuous strip basis, this spread has come full circle since 2017 - from flat to negative $15/bbl. and back. Although not yet significant, the 12-month gasoline futures strip did lose value relative to the 12-month distillate strip on Friday, as it seems to be hitting resistance at around flat. Something to watch if gasoline prices begin to materially weaken relative to ULSD prices.

In both cases above, there wasn't a material reaction to the pipeline news on Friday. We bring all of these spreads to your attention so you can gauge headlines versus reality.

Time Spreads

Spot market tightness would be the result of any significant delay in resuming operations. Since this is a transportation issue rather than an outright production issue, time spreads may be less impacted. However, since both gasoline and distillate contracts in the US are for delivery in New York Harbor, it's more probable that there will be strength in the front contracts relative to the back.

Year on year calendar spreads have been strong this year, making a huge comeback from 2020 lows. To smooth out some of the individual contract month noise, below we compare the continuous 'year one' futures strip (months 1-12) to the continuous 'second year' futures strip (months 13-24) to continuous front month futures (pink line vs black line).

The year/year spread is flirting with the $5 level that it has failed at in the past. Everyone is waiting for that next bit of news or fundamental data that can move us above this resistance area. It doesn't appear at the moment like a software hack at a major US pipeline has the teeth to do that. But, these little events add up. Next up, we have Enbridge Line 5, which is still facing a May 13 deadline to close to eliminate the risk of a major leak. Will this be another non-event?

Overall Market

The 3-year average strip price for WTI is approaching the $60 level on a continuous basis. The last time this happened was in April of 2019 and has really been the level of mean reversion in WTI over the last 5 years. Many players have long since hedged their 2021 production at lower levels. In order to realize any additional margin as prices move higher, they will need to increase production above hedged levels. This is something we will look at in further detail in future reports. Suffice it to say though that there could be a lag in the usual producer reaction to higher prices going forward, as higher prices are needed to entice fossil fuel players in today's Climate Aware environment.

In all reality, markets are pausing as they approach multi-year highs. While it was exciting to think there was an event that could finally push us above resistance, the Colonial pipeline outage may not have been it. Headlines have run the gamut, most leaning towards themes such as "The shutdown of America’s largest fuel pipeline after a cyberattack is threatening to send gasoline prices to the highest in seven years as suppliers work to stave off shortages from Atlanta to New York with tankers and barges". Watch the spreads noted above to look for 'proof' of this.

So far 2021 has provided many sensational headlines that could impact global markets. For example, the Suez Canal incident, as disruptive to global shipping as it was, didn't have a long-term impact on spreads. The Texas polar vortex had a huge impact on refinery output due to loss of power but resolved itself as quickly as Texan's say the weather changes. The Colonial Pipeline cyber attack is yet another disruption where watching the spreads will validate it's market impact.

Of Note This Week

The earliest tropical storm on record in the eastern North Pacific basin has formed: the Miami-based National Hurricane Center has upgraded Tropical Depression One-E to Tropical Storm Andres The official start of the eastern North Pacific hurricane season is May 15th while the Atlantic and Central Pacific hurricane seasons begin on June 1. No storms have formed in the Atlantic or Central Pacific basins yet for the 2021 season.

_________________________________________________________________________________

EIA Inventory Statistics Recap

Weekly Changes

The EIA reported a total petroleum inventory DRAW of 11.20 million barrels for the week ending April 30, 2021 (vs a draw of 4.60 million barrels last week).

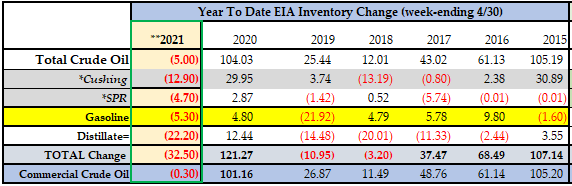

YTD Changes

Year-to-date cumulative changes in inventory for 2021 are DOWN by 32.50 million barrels (vs down 21.30 million last week).

Inventory Levels

Commercial Inventory levels of Crude Oil (ex-SPR) compared to prior years reflect progress that has been made in reducing excess inventory levels.

Comments